With the rise of computing power and new analytical techniques, banks can now extract deeper and more valuable insights from their ever-growing mountains of data. And they can do it quickly, as many key processes are now automated (and many more soon will be). For risk departments, which have been using data analytics for decades, these trends present unique opportunities to better identify, measure, and mitigate risk. Critically, they can leverage their vast expertise in data and analytics to help leaders shape the strategic agenda of the bank.

Stay current on your favorite topics

Banks that are leading the analytical charge are exploiting both internal and external data. Within their walls, these banks are integrating more of their data, such as transactional and behavioral data from multiple sources, recognizing their high value. They are also looking externally, where they routinely go beyond conventional structured information, such as credit-bureau reports and market information, to evaluate risks. They query unconventional sources of data (such as government statistics, customer data from utilities and supermarket loyalty cards, and geospatial data) and even new unstructured sources (such as chat and voice transcripts, customer rating websites, and social media). Furthermore, they are getting strong results by combining internal and external data sets in unique ways, such as by overlaying externally sourced map data on the bank’s transaction information to create a map of product usage by geography. Perhaps surprisingly, some banks in emerging markets are pioneering this work. This is possible because these banks are often building their risk database from scratch and sometimes have more regulatory latitude.

The recent dramatic increases in computing power have allowed banks to deploy advanced analytical techniques at an industrial scale. Machine-learning techniques, such as deep learning, random forest, and XGBoost, are now common at top risk-analytics departments. The new tools radically improve banks’ decision models. And techniques such as natural-language processing and geospatial analysis expand the database from which banks can derive insights.

These advances have allowed banks to automate more steps within currently manual processes—such as data capture and cleaning. With automation, straight-through processing of most transactions becomes possible, as well as the creation of reports in near real time. This means that risk teams can increasingly measure and mitigate risk more accurately and faster.

The benefits—and challenges—of risk analytics

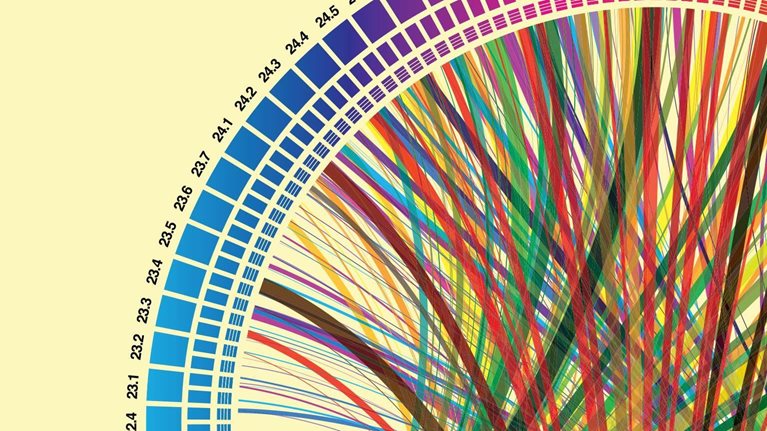

Banks that are fully exploiting these shifts are experiencing a “golden age” of risk analytics, capturing benefits in the accuracy and reach of their credit-risk models and in entirely new business models. They are seeing radical improvement in their credit-risk models, resulting in higher profitability. For example, Gini coefficients of 0.75 or more in default prediction models are now possible.1 Exhibit 1 lays out the value that analytics can bring to these models.

Some banks are expanding their risk models to new realms. A few have been able to automate the lending process end-to-end for their retail and SME segments. These banks have added new analytical tools to credit processes, including calculators for affordability or preapproval limits. With this kind of straight-through processing banks can approve up to 90 percent of consumer loans in seconds, generating efficiencies of 50 percent and revenue increases of 5 to 10 percent. Recognizing the value in fast and accurate decisions, some banks are experimenting with using risk models in other areas as well. For example, one European bank overlaid its risk models on its marketing models to obtain a risk-profitability view of each customer. The bank thereby improved the return on prospecting for new revenue sources (and on current customers, too).

A few financial institutions at the leading edge are using risk analytics to fundamentally rethink their business model, expanding their portfolio and creating new ways of serving their customers. Santander UK and Scotiabank have each teamed up with Kabbage, which, using its own partnership with Celtic Bank, has enabled these banks to provide automated underwriting of small-business loans in the United Kingdom, Canada, and Mexico, using cleaner and broader data sets. Another leading bank has used its mortgage-risk model to provide a platform for real estate agents and others providing home-buying services.

Realizing the potential

For many banks the advantages of risk analytics remain but a promise. They see out-of-date technology, data that is difficult to clean, skill gaps, organizational problems, and unrelenting regulatory demands. The barriers seem insurmountable. Yet banks can get things moving with some deliberate actions (Exhibit 2).

Perhaps the most salient issue is that risk analytics is not yet on the strategic agenda. Bank leaders often don’t understand what is really at stake with risk analytics—at times because the analytics managers present highly complex solutions with a business case attached as an afterthought. Lagging banks miss out on the benefits, obviously, and also put other programs and activities at risk. Initiatives to grow revenue and optimize pricing can founder if imprecise risk assessment of customer segments leads to poor choices. In lending, when risk models underperform, banks often add business rules and policies as well as other manual interventions. But that inevitably degrades the customer experience, and it creates an opening for fintechs to capture market share through a better experience and more precise targeting. Taken to its logical conclusion, it is conceivable that banks might be relegated to “dumb pipes” that provide only financing.

Some nimble risk groups are finding ways through these problems, however. Our analysis suggests these teams have six common behaviors:

- Take it from the top, lifting risk analytics to the strategic agenda. For example, 4 out of 10 strategic actions that HSBC Bank laid out in 2015 rely heavily on risk analytics.

- Think big and apply analytics to every material decision. Capital One is well-known for applying analytics to every decision that it makes, even when hiring data scientists.

- Go with what you have. If data is messy or incomplete, don’t wait for a better version or for a “data-lake nirvana.” Use the data you have, or find a way to complement it. When Banco Bilbao Vizcaya Argentaria (BBVA) wanted to lend to some clients but lacked information, it partnered with Destacame, a utility-data start-up, to provide data sufficient to support a way to underwrite the customers.

- Accumulate skills quickly, through either rapid hiring or acquisitions and partnerships. Then retain your talent by motivating people with financial and nonfinancial incentives, such as compelling projects. Banks such as BBVA, HSBC, Santander, and Sberbank have launched funds of $100 million and more to acquire and partner with fintechs to add their market share, sophisticated technologies, and people.

- Fail often to succeed, iterating quickly through a series of “minimum viable products” (MVPs) while also breaking down traditional organizational silos. One bank building a fully digital lending product went through six MVPs in just 16 weeks to get to a product it could roll out more broadly.

- Use model validation to drive relentless improvement. Validation teams can be the source of many improvements to risk models, while preserving their independence. The key is for teams to style themselves as the guardian of model performance, rather than the traditional activity of merely examining models.

If banks can master these elements, significant impact awaits. Risk analytics is not the entire answer. But as leading banks are discovering, it is worthwhile in itself, and it is also at the heart of many successful transformations, such as digital risk and the digitization of key processes such as credit underwriting.

Would you like to learn more about our Risk Practice?

Risk-analytics leaders are creating analytic algorithms to support rapid and more accurate decision making to power risk transformations throughout the bank. The results have been impressive. An improvement in the Gini coefficient of one percentage point in a default prediction model can save a typical bank $10 million annually for every $1 billion in underwritten loans.2 Accurate data capture and well-calibrated models have helped a global bank reduce risk-weighted assets by about $100 billion, leading to the release of billions in capital reserves that could be redeployed in the bank’s growth businesses.

Leveraging the six successful behaviors

Nothing succeeds like success. The behaviors we have observed in successful risk-analytics groups provide the guidance.

Take it from the top

Stress testing and regulatory oversight following the 2008 financial crisis have vaulted risk management to the top of the management agenda. Nine years later, and after significant investment, most big banks have regained a handle on their risks and control of their regulatory relations. However, leading banks, recognizing the value from risk analytics, are keeping these programs at the top of their strategic plans, and top leaders are taking responsibility.

Top management attention ensures commitment of sufficient resources and removal of any roadblocks—especially organizational silos, and the disconnected data sets that accompany these divides. Leaders can also keep teams focused on the value of high-priority use cases and encourage the use of cross-functional expertise and cross-pollination of advanced analytical techniques. Good ideas for applications arise at the front line, as people recognize changing customer needs and patterns, so banks must also build and maintain lines of communication.

Think big and apply analytics

For some time, analytics has played an important role in many parts of the bank, including risk, where a host of models—such as the PD, LGD, and EAD3 models used in the internal ratings-based approach to credit risk—are in constant use. What’s new is that the range of useful algorithms has greatly expanded, opening up dozens of new applications in the bank. Many small improvements to material decisions can really add up. An obvious example is algorithmic trading, which has transformed several businesses. Already by 2009, for example, it accounted for 73 percent of traded volume in cash equities. An expansion of automated credit decisions and monitoring has allowed banks to radically improve customer experience in residential mortgages and other areas. Banks in North and South America are using advanced-analytics models to predict the behavior of past-due borrowers and pair them with the most productive collections intervention.

These and other important examples are shown in Exhibit 3. What’s important is that leading banks are putting analytics to work at every step of these and many other processes. Any time a decision needs to be made, these banks call on risk analytics to provide better answers. Even as they expand the applications of risk analytics, however, leading banks also recognize that they need to strengthen their model risk management to deal with inherent uncertainties within risk-analytics models, as these make up the largest share of risk-related decisions within banks.

Go with what you have

Messy, repetitive, and incomplete databases are a reality—but need not be an excuse. Rather than waiting for improvements in the quality, availability, and consistency of the bank’s systems and the data they produce, leading risk-analytics teams ask what can be done now. This might involve using readily available data in the bank to immediately build a core analytic module, onto which new modules are integrated as new data sources become available. Alternatively, integrating two or more of the data sets on hand can generate significant value. These approaches hasten new analytical models to market, while at the same time helping the bank gather information as it forms a credit relationship with customers.

Furthermore, leading banks supplement their resources with external data—once they have established that this offers clear additional value. Some US fintechs, for example, obtain customer permission to comb financial data and create a sanitized database that banks can use to make accurate risk decisions based cash-flow patterns. A bank in Central America built a credit-approval system for unbanked customers based on data collected from supermarket loyalty cards. The bank used data such as frequency of shopping and the amount that customers typically spent per visit to estimate customers’ ability to repay debt. Even better for banks, many external data are free. In some markets, micromarket information such as house prices by postal code or employment by district is available, and can be mined for insights into creditworthiness of customers, especially small businesses. Conducting geospatial analytics on this information can also provide valuable insights (for example, proximity to a coffee-chain outlet would reveal foot traffic for a retail shop). Banks have also started analyzing unstructured data sets, such as news articles, feedback sites, and even social-network data.

Leading banks apply two tests before acquiring external data: Will it add value, typically through combination with other data sets? And does it conform with the bank’s regulatory and risk policies? Consumer-protection regulations restrict the type of data that banks can use for risk-analytics applications, such as lending and product design.

Digital risk: Transforming risk management for the 2020s

While the practices outlined here will yield fast impact from messy, repetitive, and incomplete databases, most banks would still benefit from establishing sound data governance in parallel (and sometimes are required to do so under data regulations such as BCBS 239).

Accumulate skills quickly

Strong risk-analytics teams use several roles to develop solutions and integrate them into business processes (Exhibit 4).

Recognizing that they might not have the time to build the whole arsenal of skills, leading banks have acquired companies, outsourced some analytical work, invested in fintechs, and entered into formal partnerships with analytic houses. JPMorgan Chase has partnered with OnDeck to lend to small businesses; Bank of America has committed $3 billion annually to fintech investment and joint innovation. Other leading banks have entered into partnerships with digital innovators to better understand customer behavior and risk profiles. Even when leading banks have acquired talent at scale in these ways, they still work to define roles and build skills in the risk-analytics team.

Fail often to succeed, iterating quickly

Speed is as important as completeness in realizing value from risk analytics. A winner-takes-all dynamic is emerging in the race to better serve customers. Banks, fintechs, and platform companies are getting better at locking in customers quickly with highly personalized and desirable offerings. The offerings are dependent on customer data, which get richer and deeper with every new development of risk-analytics capabilities.

To reach and exceed the speed at which this race is moving, leading banks rely on quick, narrowly defined experiments designed to reveal the value (or the futility) of a particular hypothesis. When they succeed, they constitute a minimum viable product—something good enough to take to market, with the expectation that it will be soon improved. These experiments take weeks to conduct, rather than the more traditional months-long efforts commonly seen in risk-analytics functions (and that’s not even considering the validation process). One form such experiments have taken are “hackathons”—coding sessions with analysts and others that have produced promising applications in compressed time-frames.

Use model validation to drive relentless improvement

The banks that are developing a competitive edge through analytics constantly improve their current models, even as they build new ones. They make full use of their independent model-validation framework, moving beyond providing regulatory and statistical feedback on risk models every year to a more insightful and business-linked feedback loop. Validation departments can achieve this without losing their independence by changing from a mind-set of “examiners of models” to “guardians of model performance.”

To introduce a degree of experimentation into model validation, leading banks incorporate business and model expertise into bursts of rapid development and testing, and accept that not all results will be as expected. In this way, the model benefits from a continual 360˚ review, rather than being buried in the risk-modeling team and understood only by the model owner. To be sure, as they do this work, banks must also respect regulatory constraints and explain to supervisors how they are utilizing advanced techniques. But leading institutions do not use regulatory oversight as an excuse not to move forward in an agile fashion. As shown by the multiple examples in this article, even large banks can make significant changes to improve outcomes and customer experience.

Getting started

We have outlined the reasons leading banks see considerable near-term promise in improved risk analytics, and the behaviors and principles that are distinguishing more successful players from the rest. This raises a logical question about what comes next: How can banks develop and execute a long-term bankwide risk-analytics strategy? While a full discussion is beyond the scope of this article, we see five immediate actions for the chief risk officer (CRO) to maximize the value of existing investments and prioritize new ones. These actions are all consistent with the six successful behaviors discussed above, but distilled into immediate high-payoff steps.

- Assess the current portfolio of risk-analytics projects, assets, and investments, and take a hard look at any that cannot answer the following questions satisfactorily:

- Is the initiative business-driven? Does it address one of the biggest business opportunities and define an analytics use case to deliver it? Or is the initiative a hammer looking for a nail?

- Does the initiative have a clear plan for adoption and value capture? Or is it only a “model building” project?

- Is the initiative structured to generate quick improvements as well as longer-term impact?

- Make an inventory of your talent, teams, and operating model for each initiative. Success requires multidisciplinary co-located teams of data engineers, data scientists, translators, and business experts. Prioritize actions to find the talent you need, rather than stretching the talent you have to the point of ineffectiveness.

- List your data and technology choke points—the weakest links in the system. Then determine the work-arounds you can develop to get high-priority initiatives moving (such as using external or alternative internal data or vendor solutions). Where no work-around is possible, ensure that precious resources do not lay idle waiting for resolution.

- Explain what you are doing to senior leaders, including business heads, the chief operating officer, and the chief investment officer. Work with them as needed to adjust priorities and redirect the program, but then proceed full steam ahead.

In our experience, risk leaders can take these steps quickly, given the right level of determination and focus. CROs should not hesitate to pull critical people into the exercise for a couple of weeks—it’s typically a worthwhile investment that pays off in the redirection of a much larger body of work toward maximum impact.