Over the past six weeks, executives have become markedly more optimistic about current economic conditions and prospects for their national economies, a new McKinsey survey shows.1 Expectations started out so gloomy, however, that even now, fewer than a third expect an economic upturn this year, and two-thirds expect their nations’ GDPs to decrease in 2009.

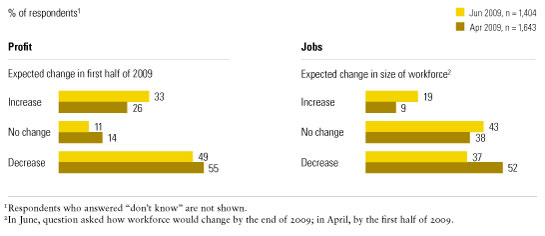

Similarly, at the company level, more executives still expect to shed workers than to hire, but the share expecting to decrease the workforce has fallen below half for the first time since January. And a full third of respondents now expect profits to increase in 2009, up 8 percent in six weeks. Furthermore, even though respondents see fallout from the crisis in a variety of financial and nonfinancial measures such as employee morale and the pace of innovation, strong majorities expect those effects to be short-lived.

More hopeful executives

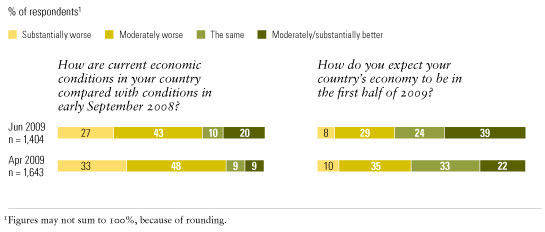

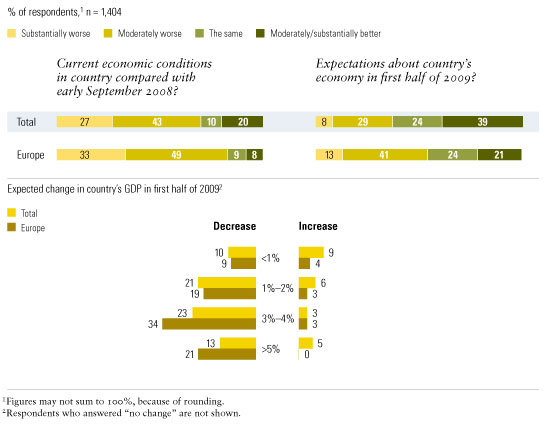

The share of executives who say their countries’ current economic conditions are better than they were in September 2008 has more than doubled since mid-April, and the proportion who expect conditions to improve by the end of the year now stands at 39 percent (Exhibit 1). Nonetheless, only 28 percent expect an economic upturn in 2009, and the share of those expecting their countries’ GDPs to decrease has fallen only slightly, to 67 percent.

When asked what single indicator they rely on to signal an upturn, most executives mention GDP, consumer spending or confidence, or employment. Several mention the degree of government involvement in the economy, saying that less involvement would be a good sign. Remarkably few mention the performance of stock or bond markets.

A doubling of optimism

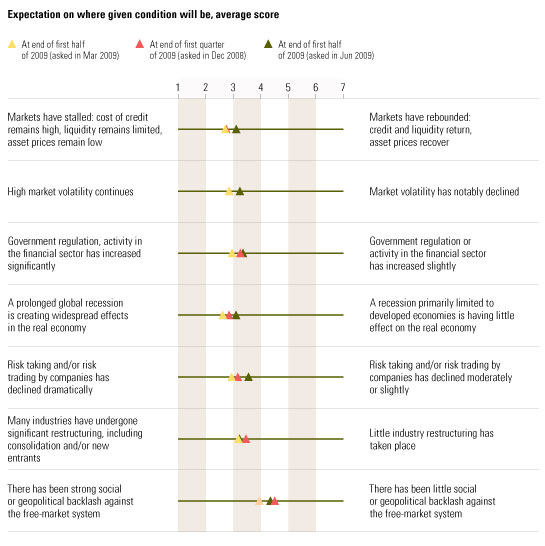

One reason for the lack of focus on markets is likely an easing of executive concern about market volatility after two months of gains. Concern about volatility, along with a mix of other trends, has generally eased since late last fall (Exhibit 2). That said, the percentage of respondents who fear a long recession has risen slightly since April, by three percentage points—by exactly the same amount as the percentage indicating hope for global economic regeneration. The likeliest overall scenario, executives say, remains a battered but resilient global economy.

On all these measures, European executives indicate less optimism than executives elsewhere (Exhibit 3).

Improvement across most trends

Gloom in Europe

The United States remains important

The global economic turmoil started in the United States and certainly has severely reduced that country’s role as a global market. However, among the quarter of all respondents who think an economic upturn will come first in North America, 35 percent expect it to occur this year—notably more than the 28 percent who expect an upturn anywhere this year. These responses continue to signal a relative optimism about the region that has been apparent since late fall of 2008.

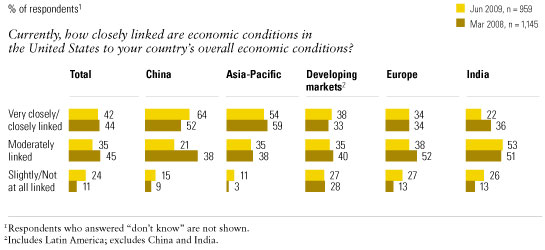

Further, though US consumers are consuming less, the nation’s economy appears not to have diminished much in its significance to other countries since March 2008 (Exhibit 4). What’s particularly notable is a shift away from a moderate degree of linkage; while far fewer executives see economic decoupling than tighter linkages, the findings suggest that the crisis is producing a shift to extremes in economic ties to the United States.

More linked to the US economy

Companies bide their time

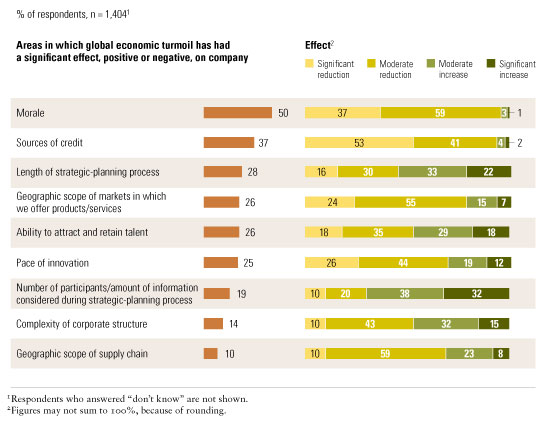

Given the scale of the economic crisis, it’s not surprising that it has affected companies in a variety of areas, from morale to strategic planning (Exhibit 5). But on a company-by-company basis, the scope of the effects is far more limited at most companies; the average number of effects that each respondent selected from a list of ten potential effects is just over two. Furthermore, these effects are expected to be short term, with most lasting no longer than two years. And for many companies, the changes have been positive. For example, almost as many executives say the crisis has increased their companies’ ability to hire as say it has decreased that ability; compared with six weeks ago, significantly more respondents now say their companies are hiring talent that would not otherwise be available.

Where the crisis hurts

More optimism about companies’ prospects

Overall, executives are more optimistic about their companies’ prospects than they were in mid-April. Indeed, for the first time since January, fewer than half expect profits to fall, and fewer than half expect to decrease their workforces (Exhibit 6).