Many automotive OEMs and suppliers in Europe, Japan, and the United States are starting large-scale launches of battery electric vehicles (BEVs) in their core markets. But in China, a rapidly growing BEV market and ecosystem have already emerged.

To help global automotive OEMs and suppliers truly understand the major challenges and opportunities of the Chinese BEV market, we analyzed ten BEVs that are popular in China using McKinsey’s electric-vehicle index. We covered a large portion of the market, looking at vehicles from both incumbent OEMs and new players. The benchmarking consisted of a detailed technical analysis, as well as a cost estimate down to the level of individual components. We summarized our findings in our report, How to drive winning battery-electric-vehicle design: Lessons from benchmarking ten Chinese models (PDF–501KB).

1. China—the world’s largest automotive profit pool—is quickly moving toward e-mobility

The Chinese automotive market is the world’s largest automotive profit pool, accounting for one-third (about $40 billion1) of the global total. The market is now shifting toward e-mobility. From 2014 to 2019, BEV unit sales in China increased by 80 percent a year. With more than 900,000 units in 2019, 57 percent of the BEVs sold throughout the world were sold in China, making it the world’s largest BEV market. A look at OEM market shares reveals that Chinese OEMs dominate the market almost completely. International OEMs had a mere 15 percent of annual BEV sales in 2019 (Exhibit 1).

The outlook for the market is promising: BEV penetration in China is expected to grow from 3.9 percent in 2019 to 14 to 20 percent in 2025—a sales volume of roughly 3.8 to 5.0 million vehicles. With the COVID-19 crisis affecting global BEV markets, China’s central government decided in March 2020 to extend purchase subsidies by two more years to fuel BEV sales. Therefore, we expect that after stagnation in 2020—compared with the double-digit growth before COVID-19—the BEV market will pick up again, both absolutely and relatively, in 2021.

2. Chinese BEV producers are on the verge of becoming profitable, given sufficient volumes

Several BEVs have the potential to be profitable, as their product cost structures benefit from several unique characteristics of the Chinese market. The reuse of existing internal-combustion-engine (ICE) platforms decreases time to market, and off-the-shelf components and a high level of modularization keep down capital expenditures. These design principles and their effects are supported by an ecosystem of local suppliers with long-established expertise across electronics and batteries.

Our bottom-up estimate of materials and production costs, based on more than 250,000 data points, reveals that nine out of ten vehicles may achieve a moderate to solid contribution margin of up to 50 percent. However, we estimate that a lower share may actually achieve a positive operating margin when we take into account warranties; selling, general, and administrative costs; R&D; and capital expenditures (Exhibit 2). The high variance in fixed costs can stem from a range of factors, such as the depth of integration and differences in sourcing strategies or the overall volume of OEMs.

New market entrants in particular need to deal with structural challenges and low overall vehicle volumes. Together with further efforts to excel in R&D, the optimization of capital expenditures through flexible manufacturing and strategic value-chain positioning could help more OEMs turn a profit with their BEV models.

3. Substantial variety in design and technology remains—the game is far from decided

Local OEMs have demonstrated a position of strength in the Chinese BEV market, but a deeper look at the technology reveals that substantial differences across OEMs remain. Variations in three aspects of vehicles will influence the development of next-generation BEVs and may provide an opportunity for others to gain a foothold in the market.

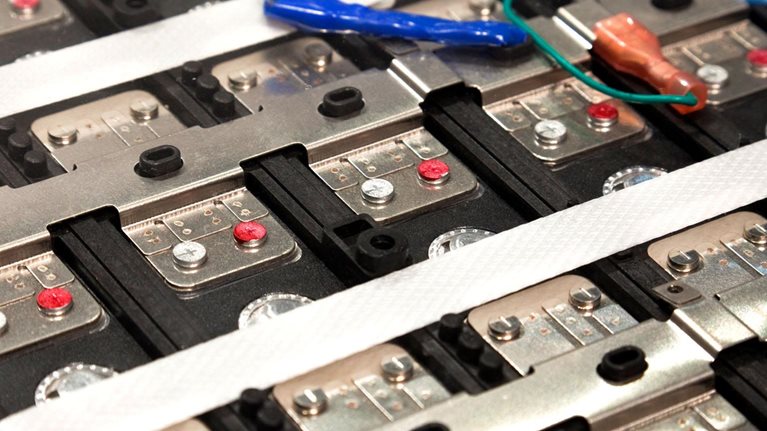

E-powertrain. The benchmark revealed a wide variety of concepts throughout the e-powertrain, such as the battery layout, the thermal-management design and routing, and drivetrain-module integration. Our 3-D models show that half of the benchmarked models use grid and row layouts for the battery pack, increasing the utilization of space and, potentially, lowering module-production costs.

E/E architecture. The benchmark shows that the weight of low-voltage wiring and harnesses differs among models with similar functionalities. That suggests significant design and cost-improvement opportunities in the E/E architecture. Similarly, OEMs of the benchmarked BEVs chose different ADAS2 functionalities, use different designs for the electronic-control-unit (ECU) integration, and differ in the number of ECUs used. The benchmarked BEVs have six to 19 decentralized ECUs. One potential direction would be to integrate all functions in one vehicle controller, as a BEV player in the United States does. That might increase performance at a relatively low cost but calls for substantial R&D investments and advanced internal software-development capabilities.

Would you like to learn more about the McKinsey Center for Future Mobility?

Trim packages. Chinese BEVs offer two to four trim packages on top of the base model. That reduces complexity and costs compared with the larger portfolio of options common among Western OEMs. Seven out of ten benchmarked models therefore have a price spread of less than 50 percent between the base models and the fully loaded ones (Exhibit 3). Five out of ten offer battery or motor upgrades independent of the trim package, and three offer priced exterior options, such as color and wheels. Consequently, there might be untapped revenue potential in pricing strategies or nonhardware revenues, such as over-the-air software updates. Overall, global automotive OEMs may use our findings as a signal to simplify their portfolios or as a point of differentiation, especially when they think about entering the Chinese market.

4. How to play in the market successfully

For each of the trends that we identified in the Chinese BEV market, there is an associated strategic action or opportunity.

Development cycles are accelerating. To increase profitability and achieve a competitive advantage, OEMs are speeding up the development cycles of their BEVs. For current (and mostly first-generation) models, OEMs have cut time to market by reusing or modifying existing ICE platforms and relying on off-the-shelf components. But it is expected that for the next generation of BEVs, time to market will continue to shorten thanks to dedicated BEV platforms, given the cost and design advantages at higher volumes.

Market composition will probably change. There are now around 80 BEV brands in China owned by about 50 companies. Of these, 12 are start-ups, with a market share of approximately 7 percent in 2019.3 However, start-ups—especially if they haven’t started production yet—will find that market conditions become increasingly unfavorable to them as a result of their cost structures. In particular, high fixed costs at low volumes burden these companies, so any start-up that cannot scale up quickly will disappear. By contrast, international OEMs are expected to capture additional market share, since they must extend their penetration of the BEV market to adhere to regulations, such as dual-credit policies.

Trends in electric-vehicle design

E-powertrain technology will standardize. The observed technological variance in batteries, power electronics, E/E, and e-drives is expected to decline. The market will converge on just a few standardized designs, as happened with ICE powertrain designs. This presents a significant opportunity for suppliers that can deliver integrated platform solutions for the powertrain, especially if they have a competitive capital-expenditure base through synergies and economies of scale.

Native BEV platforms will gain higher shares. The benchmark shows that Chinese OEMs have realized short time to market by using shared or modified ICE platforms. However, higher BEV volumes will justify the development of dedicated BEV platforms to achieve design and cost advantages. Moreover, it is expected that BEVs will increasingly be produced on dedicated production lines instead of (at present) flexible, shared ICE/BEV production lines.

Non-Chinese OEMs will need to leverage their assets, such as an exciting brand image, superior engineering expertise, and state-of-the-art production facilities, to differentiate themselves from their Chinese competitors. Simultaneously, they must simplify their portfolios to offer fewer but highly targeted and locally adapted options, supported by additional revenue streams through software and other technologies. In contrast, Chinese OEMs should continue to increase their profitability by focusing on cost savings while increasing their revenues through more differentiated offerings. Sophisticated pricing strategies and new revenue streams will be important.

Download How to drive winning battery-electric-vehicle design: Lessons from benchmarking ten Chinese models, the full report on which this article is based (PDF–501KB).