Fluid-hydraulic pumps power a broad range of production processes across multiple industries, from pharmaceuticals and chemicals to oil and gas. Compared to other systems, though, pumps are outsize energy consumers. But recent technological leaps—smart-pump technology, or “smart fluid hydraulics”—could increase energy efficiency, uptime, and productivity. While these technologies have high up-front costs, companies can recoup their investment over time through lower operating expenses.

Our recent report, Smart fluid hydraulics: Preparing for the imminent revolution in the fluid systems industry, provides an overview of the changing industrial-pump market and the opportunities ahead for smart fluid hydraulics and related equipment. A link to the full document appears at the end of this summary.

Market size and revenue sources

Recent McKinsey research shows that the global industrial-pump market is worth approximately $70 billion today. By 2025, the market is projected to be worth $85 billion to $90 billion. Original equipment accounts for approximately 70 percent of the global industrial-pump market, while aftermarket represents the remaining 30 percent. The design archetypes for original equipment include standard pumps, special-purpose pumps, and engineered pumps. Aftermarket breaks down into three main revenue sources: OEM parts, third-party parts, and service.

Would you like to learn more about Creating value in the specialty-pumps market?

The smart fluid hydraulics–equipment industry includes five main segments:

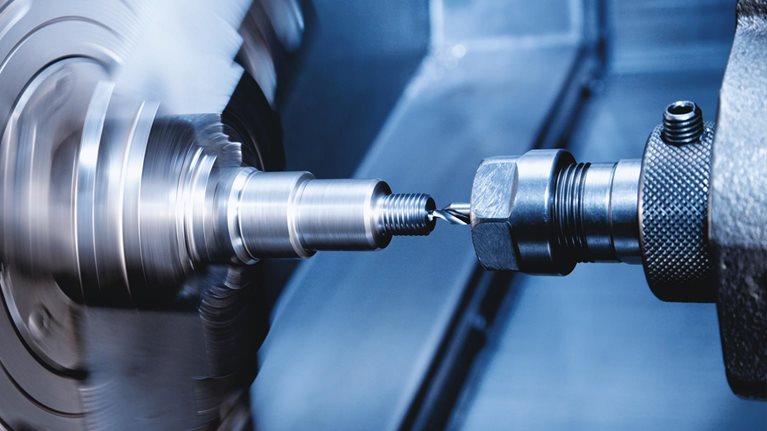

- Centrifugal pumps. These pumps add kinetic energy to a fluid using a spinning impeller. They represent the largest segment and had a global market size of $30.3 billion in 2019, $8.6 billion of which was in the European Union.1 Approximately 79 percent of this value was generated from single-stage, multistage, and submersible pumps that were used for higher-pressure applications.

- Positive-displacement pumps. These pumps pressurize fluid by trapping a fixed amount of fluid with each piston stroke, which is then squeezed and displaced. They accounted for $8.1 billion in revenue in the global pumps market in 2019, with most of the revenue coming from diaphragm, piston, and gear pumps. The European Union accounted for $1.6 billion of that revenue.2

- Other pumps, including specialty pumps. These cover a wide range of technical specifications. They include jet engines, electromagnetic power, and gas compressor technology.

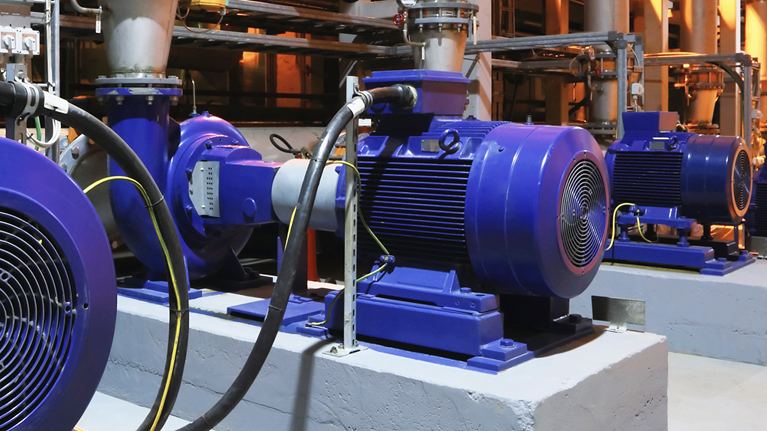

- Pump sets. These pumps combine a fluid hydraulics unit and a drivetrain unit that are typically sold as separate modules. Special configurations, through which both are sold as an integrated system, started entering the market in 2010, and their market share is expected to increase significantly.

- Pump services. This category covers plant maintenance, attempts to reduce operating expenses, and maintenance of aging asset infrastructure. Revenue for these services reached $15.6 billion globally in 2019.3

Core elements of strategy development

Process industries such as steel, oil and gas, pulp and paper, pharmaceuticals, and food and beverage could benefit significantly from smart hydraulics. Industrial processes account for 42 percent of power consumption in the European Union, and pumps consume the highest share of energy at 30 percent (exhibit).

Some OEMs have already introduced smart fluid-hydraulics products and may have already gained a competitive advantage. Other companies that are developing new technologies can still capture great growth and sales potential, however. The following no-regrets moves can help them develop component and service offering strategies:

- Reassessing company strategy and technology road maps. The introduction of smart fluid hydraulics entails a profound rethinking of the value chain for industry players. This may include investigating new revenue streams and capabilities or possibly cannibalizing their existing business. Equipment OEMs will need to assess their company strategies, define their technology road maps, and make a conscious decision on when to develop which type of smart fluid-hydraulics application.

- Considering integrated systems instead of single components. The most successful companies will offer a one-stop solution to customers and serve as an interface for single-component players.

- Focusing efforts on a limited number of relevant use cases. Companies will benefit from limiting the scope of their efforts rather than trying to target as many use cases as possible.

- Defining and building required future digital capabilities. Companies will need to build a strong, cross-functional internal team with an agile mindset and digital and software skills. They would also be well advised to establish and nurture external partnerships with others in their business and technology ecosystems.

- Developing a marketing and sales strategy. End customers may not fully understand the benefits of the latest fluid-hydraulics solutions in the market. To assist them, product marketing should clearly describe the underlying business cases and outline their benefits.

Would you like to learn more about McKinsey's Advanced Electronics?

End-customer priorities

In addition to looking at strategies for companies in the fluid hydraulics–applications industry, we also examined end-customer needs, focusing on five industries: chemicals, pharmaceuticals, oil and gas, food and beverage, and pulp and paper. Here’s a look at some key findings:

- Chemicals. Smart fluid hydraulics that allow companies to streamline and automate manual activities represent an important lever for yield enhancement in chemical plants in Europe. By contrast, yield enhancement in Asia can primarily be achieved through leveraging state-of-the-art fluid-hydraulic systems that allow multiple plants to be controlled by a central station. Companies may be particularly interested in advanced process control via control rooms, sensor- or robotics-based maintenance, and shop floor steering and information digitalization.

- Pharmaceuticals. Cost pressure is more intense for generics producers and contract manufacturing organizations (CMOs) compared to innovators, meaning applications for fluid hydraulics might be particularly important to them. Filling and packaging lines in the pharmaceuticals industry offer room for efficiency gains because of the time required for retooling, maintenance, and troubleshooting. Smart fluid-hydraulics pumps might drive improvements that increase yield substantially. In combination with AI applications, this may also cover yield improvements in core processes.

- Oil and gas. Within this sector, most maintenance, monitoring, and control efforts are linked to pumps and their associated core and auxiliary processes. Although pumps must be continuously controlled, there is a large discrepancy between facilities equipped with sensors and remote-control capabilities (including central control rooms) and those that still rely on the manual effort of technicians. Hence, players in the oil and gas industry could greatly benefit from smart fluid-hydraulics processes, particularly advanced process control via control rooms and smart sensors; predictive maintenance, including appropriate algorithms for the early detection of leakages and downtime; and sensor-based monitoring to control vibrations and inlet and outlet pressure.

- Food and beverage. In combination with AI applications, smart fluid-hydraulics pumps can boost yield by supporting the agile treatment of smaller batches of different product categories. In addition, predictive maintenance and process control may increase uptime and pass-through. Ultimately, optimizing overall fluid-hydraulics systems enables additional energy cost savings—for example, through reusing heating and cooling processes.

- Pulp and paper. Simultaneous improvement of overall fluid systems should be a top priority for pulp and paper players because of the potential to improve costs and throughput. Implementation is typically slow, however, because of long turnover times driven by high capital expenditures. Advanced process control in control rooms and predictive maintenance could improve yield and reduce downtime and costs.

Download the full report on which this text is based, Smart fluid hydraulics: Preparing for the imminent revolution in the fluid systems industry.