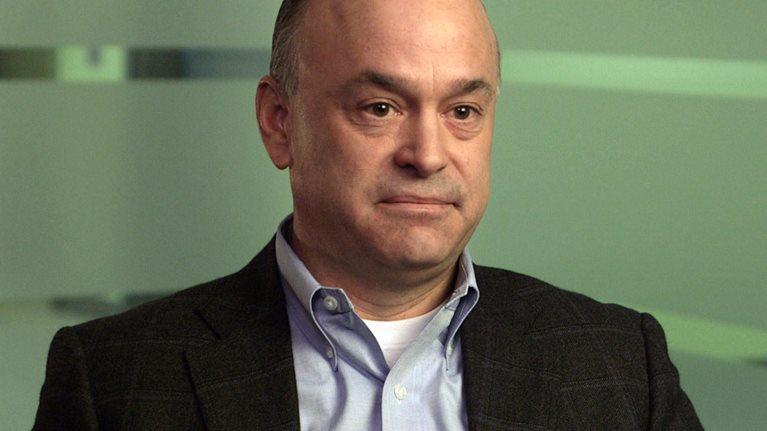

Semiconductor executives are closely monitoring the development of the Internet of Things—in which physical objects are equipped with sensors and other devices that allow them to share and receive data through a network. Examples of applications in this area include smart watches, fitness bands, and home- and industrial-automation tools. Some are predicting a multitrillion-dollar market opportunity. Joep van Beurden, chief executive officer of CSR, a fabless semiconductor company that produces wireless technologies, agrees but notes that the Internet of Things still hasn’t reached its tipping point. “I don’t think it has been overhyped by any means. I just think widespread adoption will happen later than we expected,” he says. In this edited conversation, Mr. van Beurden discusses growth in the Internet of Things market and the implications of this connectivity trend for semiconductor companies.

McKinsey: How would you assess growth in the market for Internet of Things applications relative to the industry’s expectations?

Joep van Beurden: In relative terms, you might say the growth is impressive, but the base is still very small. In absolute size, the market for Internet of Things applications is much smaller than what everyone predicted three or four years ago. Of course, the same sort of thing happened with Bluetooth development in the late 1990s: every year analysts predicted we would see a significant increase in Bluetooth-enabled devices, and every year it didn’t happen—until the early 2000s, when Bluetooth was adopted by leading cell-phone manufacturers and the technology took off. We’re all still waiting for that inflection point with the Internet of Things.

McKinsey: Which applications do you see as having the greatest promise?

Joep van Beurden: It’s hard to predict. Everyone was initially excited about the promise of wearables but, looking at that market a year and a half later, the uptake has been relatively slow—certainly nowhere near the 100-million-plus device market required to bring the Internet of Things to scale. Many companies are hedging their bets across different industries and shipping reference designs and development kits to a variety of players, small and large. Those players are working on innovative ideas in home automation, medical devices, automotive, and other industries. But it’s been a struggle to identify the one Internet of Things application that is going to take off.

McKinsey: What is inhibiting growth in the Internet of Things today?

Joep van Beurden: A lot of analysts have evaluated the potential financial value that Internet of Things applications may create over the next five to ten years—it’s a $300 billion or $15 trillion opportunity, depending on whom you listen to. When you drill down, however, you see that about 10 percent of this value is created by the “things,” while 90 percent comes from connecting these things to the Internet. The Internet of Things is not just about storing information in the cloud; the data only become interesting when you combine them with sensors and analytics. But a certain degree of alignment must happen for those connections to take place and for the Internet of Things to take off. The industry must adopt common standards and business models, and it must address issues relating to privacy and security.

Getting alignment in all these areas is easier said than done. Consider connectivity efforts in healthcare. Having an Internet of Things–based ecosystem in which medical information is stored in the cloud and accessible by individuals and healthcare professionals from anywhere in the world looks good on paper. But the multiple hospitals and healthcare organizations involved will likely use different protocols for exporting information into the cloud. And not all medical institutions and individuals may be interested in sharing their information. There needs to be alignment on how to collect information and from whom, how to port it to the cloud, how to encrypt it, who will access it and how, and so on.

We are not in that aligned world today. It will happen eventually, because the prize is so large, but it will take time.

McKinsey: Semiconductor players are quite far down in the Internet of Things application stack. How important will this network be for semiconductor growth in the coming years?

Joep van Beurden: Cost and power improvements from semiconductor players will come in time, once a killer application is introduced and achieves the 100-million-plus devices mark. Then highly integrated, cost-efficient devices will be possible. However, it is more important for semiconductor players to recognize that the “things” themselves—the chips they produce—are not going to be the game changers. Sure, they may add $30 billion in new revenue through Internet of Things applications, and that would be great, but it will not significantly change the dynamics of the semiconductor industry. We are a low-growth industry, and that is not going to change by selling a few more “things.”

McKinsey: What role can semiconductor players have in driving Internet of Things adoption? Will this require a change in designers’ and manufacturers’ business models?

Joep van Beurden: A critical challenge for semiconductor players will be how to capture more than the 10 percent of value from the things while not stepping too far into uncharted territory—for instance, exploring business models that you have limited capabilities in. It’s a fine line. Semiconductors should not become services companies; they need to look instead at where the silicon and the Internet intersect and find ways to enable that connection. For instance, we acquired Reciva, a cloud-based streaming audio aggregator. The company does not offer streaming music or online radio stations; it provides the API layer that allows consumers to get content from streaming music services and online radio stations seamlessly. By enabling the silicon, Reciva allows consumers to access the data in the cloud and do things with them that make the streaming services or online radio stations that are part of its network more valuable.

This sort of enabling model can provide an opportunity for semiconductor players to have their say in standards development. It can also become a nice stepping stone toward larger application markets in industries where the value chain is not as well developed. In retail, for instance, many companies are just now exploring the use of beacon technology—a category of low-power, low-profile transmission devices that can help retailers provide personalized services to shoppers. The projected market value of the beacons themselves is $60 million a year—a nice figure but not one that will be game changing for my company or others in the semiconductor industry. But because of the information the beacons can provide—what are people buying, and how much?—they will hold a value far greater than $60 million for the retailers that use them. The question is, how do we insert ourselves into that value chain?

McKinsey: Should incumbent semiconductor players feel threatened by the Internet of Things? Are they taking enough risks to innovate?

Joep van Beurden: The short answer is no, they shouldn’t feel threatened, and they don’t need to take enormous risks. But it is worth noting that over the past ten years we have not grown this industry in any significant way. Every semiconductor CEO is looking for growth in a nongrowth industry. For players in the traditional semiconductor market, the Internet of Things may spark some growth, but it certainly will not change 2 percent industry growth today to the 10 to 15 percent growth we had in the 1980s. In this case, the goal of innovation is not about developing and selling more things; it’s an opportunity to rethink the business model—just a little, not in any radical way—and try to create value within the cloud.

McKinsey: Are investors and shareholders supportive of the semiconductor industry making bets and experimenting in the Internet of Things?

Joep van Beurden: It’s still too early to tell, but investors and shareholders have generally been supportive; they are certainly not impeding progress to this point. There has also been a lot of interest from the venture-capital industry, although most of it has been focused on pure-play cloud companies. In our industry, there are quite a few hardware Internet of Things players trying to achieve the lowest prices, or power, or what have you for specific Internet of Things applications. Personally, I don’t believe that will be the way to create significant additional value; it is a race to the bottom. For me the answer lies in connecting the hardware in a smart way to the cloud, not just in making chips smaller, lower in power, and lower in cost.