This article was collaboratively written by colleagues from the McKinsey Center for Future Mobility. The authors include Andreas Breiter, Paul Hackert, Will Han, Russell Hensley, and Dennis Schwedhelm.

Electric mobility was just about to reach a tipping point in core markets when COVID-19 hit, disrupting automotive sales worldwide. With battery electric vehicles (BEVs), as with other categories, the impact varies widely by region, depending on government intervention, infection rate, and other factors. In regions where governments are trying to encourage electric-vehicle (EV) sales growth through various policies and regulations, the BEV market is expected to grow. For instance, China could see higher sales because the government recently extended purchase subsidies through 2022, and Europe is providing OEMs with EV-production incentives tied to its targeted fleet average of 95 grams of CO2 per kilometer. In the United States, where the government has relaxed emission standards and imposes relatively low gas taxes, BEV sales are expected to decline more steeply and take longer to recover.

Even in countries where BEV sales are picking up, many automotive executives are concerned about profitability. Some EV OEMs have already begun investigating changes to their go-to-market models that may increase sales and reduce costs quickly. Over the midterm, however, they will need to apply additional measures to be profitable, and our recent research shows that three levers will be particularly important in this respect:

- R&D excellence. Four research and development (R&D) levers—platform modularity, virtual prototyping, agile processes, and complexity management—can increase R&D efficiency by 15 to 20 percent.

- Flexible manufacturing. Staggering spending can enable companies to defer about 25 percent of large capital expenditures (capex) while providing near-term flexibility as volume slowly ramps up.

- Value-chain integration. Buying battery cells, e-motors, and inverters while retaining battery-pack integration and assembly in-house can reduce total vehicle cost by roughly 2 to 3 percent compared with an outsourcing strategy.

These three levers, combined, can produce major reductions in total vehicle cost over the midterm. Exhibit 1 shows the percent of total vehicle cost that each lever can address; these percentages vary by vehicle.

The current BEV market

Stronger regulations and growing consumer interest have recently accelerated the market shift toward EVs. For BEVs, a continuous decline in battery prices has contributed to growth and helped market penetration grow more than 40 percent annually from 2016 through 2019.

China, which accounted for 50 percent of BEV sales in 2019, is now the largest market. But OEMs in many countries are aggressively pursuing opportunities in this space, as shown by their recent model introductions and announcements, and sales are rising in most regions. According to recent McKinsey analysis, global BEV-related capex spend could increase to about $120 billion over the next five years (Exhibit 2).1

Despite the increased demand, OEMs will find the path to BEV profitability challenging. In a recent McKinsey survey of stakeholders in BEV production, only 18 percent of respondents expected a profit margin above $3,000 per vehicle; equally concerning, more than half expected a margin of less than $1,000 per vehicle.2 Overall, Asian OEMs had a more positive profit outlook (Exhibit 3). Their upbeat projections may be partly explained by China’s higher incentives, which allow OEMs to price BEVs more aggressively, or by the cost reductions that many Chinese OEMs have obtained by producing BEVs on modified internal-combustion-engine (ICE) platforms.

Levers for reducing BEV costs

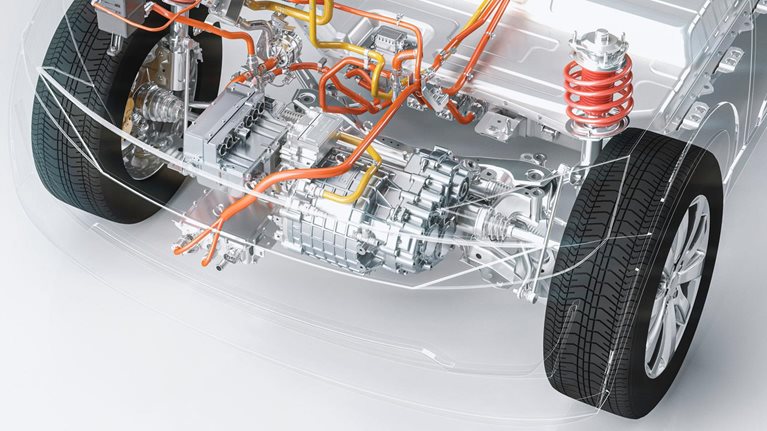

With profitability uncertain, cost reduction is a priority. While OEMs should certainly minimize variable costs for BEVs whenever possible, they must also find opportunities to reduce fixed costs in three areas. First up is R&D. The product-development process for a new model takes about three years—33 to 38 months—even though BEV designs are simpler than ICE designs. This extended time frame ties up significant engineering resources that compete with ICE portfolios. If companies can improve R&D efficiency and reduce timelines, they can directly reduce vehicle costs The second major area is manufacturing. An OEM’s existing footprint is typically complex. Building a one-size-fits-all dedicated BEV production line requires substantial investment. With volume uncertainties, amortized capex can exceed $1,000 per vehicle. Taking a more flexible manufacturing approach can allow companies to defer investment until volumes ramp up. Finally, batteries, e-drive, and other BEV components add significant cost to the final product. To keep expenditures in check, companies need to reconsider their make-versus-buy decisions for all systems and components.

Would you like to learn more about the McKinsey Center for Future Mobility?

R&D excellence

OEMs have made significant leaps in ICE R&D efficiency over the past 40 years. Time to market has fallen substantially, going from 55 to 65 months in the 1980s to 36 to 44 months today, thanks to virtual simulation, design tools, and prototype-tooling technologies. With their simpler powertrain configurations, less complex manufacturing processes, and the elimination of extended emission testing, the time to market for BEVs is already about three months shorter than that for ICE vehicles, potentially making the R&D process about 5 percent more efficient (Exhibit 4).

Our BEV benchmarking shows that many Chinese OEMs have already benefited from targeted cost allocation to areas most interesting to local consumers. One example is the strong focus on providing appealing user features and integrated experiences on the human-machine interface system. The majority of Chinese OEMs also leverage existing platform designs, often stemming from ICE architectures, which not only speaks to their focus on local consumer interests but also can unlock additional R&D efficiencies. But OEMs can achieve even more R&D gains by applying four levers related to platform modularity, agile processes, virtual prototyping, and complexity management. Together, these levers could improve R&D efficiency by an additional 15 to 20 percent and decrease time to market by up to ten months.

Platform modularity. While Chinese players mainly use shared or modified ICE or xEV platforms to help boost production volume, other OEMs prefer native BEV platform designs that provide higher battery capacity and longer range. For second-generation native BEVs, a “skateboard” type of modular design can further unlock significant R&D efficiency gains.3

Agile processes. Beyond architectural and platform changes, OEMs can improve R&D efficiency by implementing vehicle-program-centric agile development processes. Agile processes, such as quick iterations and trust/delegation, can increase R&D productivity by 20 percent, reduce time to market, and decrease warranty expenses by 30 to 50 percent.

Virtual prototyping. Virtual validation and testing will help shorten time to market, leading to greater profitability by reducing expenses for physical prototyping and testing. Done well, virtual development can reduce the expense of redesigns and tool changes for problems found during preseries launch. Eventually, virtual prototyping may completely replace physical prototyping.

Complexity management. OEMs may also decrease R&D timelines by taking a new view of product differentiation that involves placing limits on the number of hardware combinations to manage complexity. For instance, they might differentiate products based on software, including over-the-air options, rather than hardware features.

Flexible manufacturing

When it comes to BEV manufacturing and assembly, OEMs face two major decisions (Exhibit 5). First, they must opt for either dedicated or flexible assembly lines. While a dedicated line can increase speed, reduce labor, and minimize complexity, flexible lines allow companies to adjust production quickly and at low cost over the near term. That said, flexible lines are associated with higher long-term capex than dedicated lines. The other big decision involves choosing between a single-or multiple-decking approach to connect the e-powertrain and the vehicle’s upper body structure, often called the “top hat.” With a single-decking approach, the front chassis module, rear chassis module, and battery pack are decked at one station. In a multiple-decking approach, these systems are typically at three separate stations to reduce complexity.

To date, OEMs have taken various approaches when launching BEV models. When an OEM achieves scale in a region (production of more than 150,000 vehicles annually), a dedicated BEV line with a single decking point between the skateboard and top hat is likely the best option. In North America, building a new dedicated BEV assembly line by converting an old ICE plant makes the most economic sense, even for start-up OEMs. Compared with launching a new ICE model on an existing ICE line, launching a new BEV on a converted ICE line would require about 10 percent additional capex.

There are sometimes advantages to flexible lines and a multidecking approach. For instance, flexible lines allow most OEMs to avoid a high up-front capital commitment when BEV volumes are low, but still give them the option of ramping up production later. Generally, OEMs can easily integrate well-planned flexible lines with existing ICE lines after making minimal floor-plan overhauls. Typically, flexible lines allow OEMs to defer up to 25 percent of the required capex investment until volume ramps up—a benefit not possible with dedicated lines (Exhibit 6). With multidecking, the advantages arise because this approach allows for more efficient assembly. For instance, OEMs can install batteries after BEVs roll off the main line, reducing capex by 5 to 10 percent while improving line speed.

No single manufacturing option is optimal for every company. Based on an OEM’s projected volume, footprint, and product portfolio, one approach could trump the others and create the most economic value. What’s important is that OEMs thoroughly consider each option in light of their unique circumstances.

In addition to selecting the appropriate line and decking approach, OEMs can optimize production costs by focusing on customer segments during vehicle design and specification. They can also find savings by using or reusing industry-standard parts and carryovers. Finally, a design-to-cost or design-to-value approach can reduce expenses for the e-powertrain.

Value-chain integration

With advances in BEV technology, the battery market will likely reach $100 billion in size by 2025, while the e-drive market will likely reach $30 billion.4 Within the battery value chain, most OEMs buy single components, such as battery cells, but prefer to keep software development and many other integration and assembly tasks, such those for battery packs, in-house. With e-drive, a similar pattern occurs, with most buying high-voltage inverters while outsourcing transmissions. For e-motors, OEMs are equally divided between in-house production and outsourcing (Exhibit 7).

As they increase BEV production, OEMs should reevaluate their value-chain strategy, including their make-versus-buy choices for both battery and e-drive components. Their assessments should consider seven factors: organizational focus, internal innovation capabilities, the degree of uncertainty regarding demand and technological advances, capex and other economic issues, production speed, external constraints, and the desire for production control. If an OEM has never manufactured battery cells, for instance, it may need to make a significant investment in talent and facilities before moving into this area. Some external constraints may also complicate matters, such as the need to convert ICE plants into BEV facilities to create the battery cells. These factors must be weighed against the benefits of in-house production, such as the ability to secure a steady supply of high-quality battery cells.

Each OEM may reach different conclusions from such analysis. That said, an OEM with a typical production volume of under 50,000 vehicles annually will likely find it most cost-effective to buy battery cells, e-motors, and inverters while keeping integration and assembly of battery modules and packs, as well as battery software development, in-house. As volumes increase, it may become more advantageous to in-source more components. Here’s what we found to be true for most players:

Battery value chain. The typical OEM will gain a financial advantage by making its own battery packs when production volumes exceed 50,000 in a region. However, it will need to produce more than 100,000 vehicles to gain a financial advantage from the in-house production of battery modules. In addition to increasing gross margins, in-sourcing battery pack and module assembly allows OEMs to ensure that the interface between the battery and vehicle is working properly. In addition, in-sourcing would allow that some workers from ICE production lines could be reskilled for BEV powertrain assembly. For battery cells, the size must exceed 15 gigawatts or production must exceed 500,000 units in a region to achieve manufacturing efficiency and ensure profitability. Otherwise, OEMs may never recover their high R&D investment.

E-drive systems. In this area, cost will be the major differentiator. BEVs that scale first will have lower costs. For performance, software will be the main differentiator, with periodic upgrades potentially increasing an OEM’s competitive advantage. In consequence, the typical OEM will benefit from buying e-drive components and then integrating them in-house. It will also benefit from keeping software development in-house, since it will have more control over the type and frequency of upgrades. We do not expect an increase in BEV volumes to have a major influence on make-versus-buy decisions for e-drive systems.

The sidebar, “Make-versus-buy decisions,” shows what the typical OEM will consider when deciding whether or not to in-house production of specific components.

A revised approach to value-chain integration can yield big rewards, such as reductions of up to 4 to 5 percent in the cost of BEV-specific content, including the battery and e-drive (Exhibit 8). Total vehicle costs might fall by 2 to 3 percent.

How to drive winning battery-electric-vehicle design: Lessons from benchmarking ten Chinese models

The need for partnerships

Most OEMs do not have all the required capabilities, such as the ability to develop software for both batteries and e-drive, to move BEV production completely in-house. Consequently, they often need to form strategic partnerships across the ecosystem, including those for BEV design, manufacturing, and component sourcing. These partnerships will also allow them to share the burden of capex spending until they achieve sufficient scale.

Partnerships can take many forms, such as joint ventures, and OEMs may form links across the value chain, such as those with battery suppliers. These partnerships may have various goals, from securing a supply of high-quality lithium-ion battery cells to codeveloping vehicles to building a supporting charging infrastructure. Managing such partnerships will require close attention and the ability to lead a complex network.

BEV profitability will continue to face headwinds from high e-drive and battery costs, as well as the need for high investments at a time when sales volumes remain challenged. By focusing on additional cost reductions in R&D, manufacturing processes, and value-chain integration, companies may realize profitability and put themselves in a stronger position as the BEV market gains traction.