Sustainability is nonnegotiable—it is a debt we owe to future generations. While decision makers understand the urgency of this goal, they also often view sustainability as a compulsory obligation. Being green and achieving growth are not mutually exclusive. Pursuing both together opens new opportunities, from carbon-neutral industrial production to a comprehensive circular economy.

Playing offense now

While a much bigger push is needed, redistribution to meet net-zero targets is already underway. This shift is boosting demand for climate-friendly goods and services and the green energy, equipment, and infrastructure needed to produce them.

Studie: Deutschland hat bei Klimawende vergleichsweise gute Ausgangsposition

Um „Net Zero“ zu erreichen, ist bis 2050 auf globaler Ebene eine 60-prozentige Steigerung der Investitionvolumen im privaten Sektor im Vergleich zum derzeitigen Niveau erforderlich. Dies sind 9,2 Billionen US-Dollar pro Jahr bis 2050 – und damit die größte Kapital-Reallokation seit dem Zweiten Weltkrieg. Dies erfordert beherztes Handeln – schneller, in höherem Maße und mit effektiveren Mitteln.

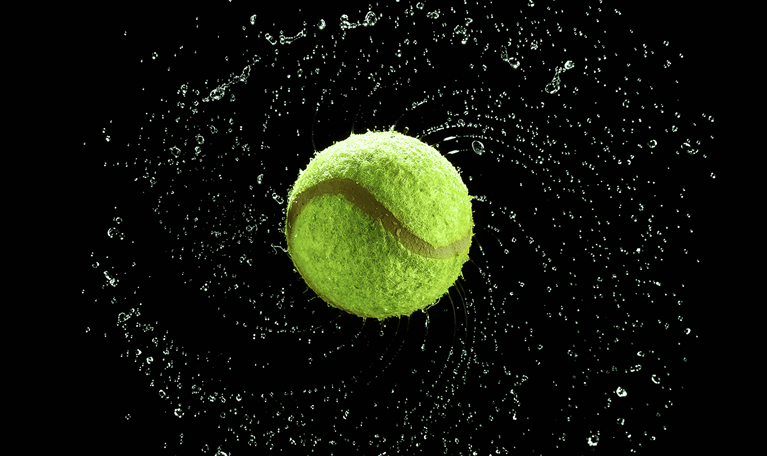

Spiel, Satz, Sieg: mit der Klimawende gewinnen

Dieser Report quanitifiziert, wie groß die Chancen für Unternehmen sind und zeigt die erfolgreichen Ansätze auf, die führende Unternehmen wählen. McKinsey hat 11 Wertpools identifiziert, die bis zum Jahr 2030 einen Jahresumsatz von mehr als 12 Billionen US-Dollar generieren könnten.

Transforming high-emission companies

Hard-to-abate sectors account for 81 percent of the global economy’s carbon footprint. We are working with these industries to accelerate the transition to net-zero emissions. Net-zero transitions for complex energy and industrial systems are extensive and require changes in all areas, from capital allocation and product design to land use. We help our clients accelerate green transformations while ensuring that the economy isn’t negatively impacted.

McKinsey Platform for Climate Technologies

We launched the McKinsey Platform for Climate Technologies (MPCT) to help clients plan, execute, and scale the implementation of critical climate technologies. We focus on the most critical technologies: those with the potential to transform our sources of energy for every industry, region, and community.

$1 billion investment

Over the next five years, we’re investing $1 billion to help our clients, lead innovation, and grow green. Some of this investment goes to strategic acquisitions to enhance our capabilities, such as Vivid Economics, Planetrics, and Material Economics. Other examples include the McKinsey Academy for Sustainability, which trains boards, executives, and colleagues on climate change, and several technology centers of excellence, which develop groundbreaking innovations for batteries, hydrogen, carbon capture, nature-based solutions, water, plastics, and more.

Sustainability

A healthy society depends on a healthy planet, and climate change is putting both at risk. That’s why, in addition to serving clients and sharing insights, we are committed to achieving net zero as defined by the Science Based Targets initiative (SBTi) by 2050, and have defined clear short-term milestones to get us there. We’ll accomplish this by:

Cutting our own emissions

We have validated, near-term science-based targets to reduce by 2025:

- Our absolute emissions from offices and company cars by 25%

- Our travel emissions per colleague by 35%1

To accomplish these, we’re:

- Embracing remote and hybrid working models to reduce travel

- Purchasing sustainable aviation fuel to make our travel more sustainable

- Electrifying our company cars or offering alternative mobility options

- Reaching 100% renewable electricity by 2025.

By 2050, we will reduce direct emissions by 90% and travel emissions by 97% per FTE vs. our 2019 baseline.

1 This target was validated by the SBTi in September 2024.

Compensating for remaining emissions

We have compensated for all our unabated emissions since 2018.

We are continuously reevaluating our carbon credit portfolio and will shift to 100% carbon removals by 2030 through:

- Natural climate solutions (NCS) to address both the climate and nature crises

- Technology-based solutions, like our partnership with Frontier to develop and scale permanent carbon removal technologies needed beyond NBS

These are financed through our internal carbon fee of $50/t on 100% of emissions

Catalyzing climate action now

Climate change is too big of a challenge for any one organization to take on themselves, so we work closely with:

- Clients, nonprofits, and peers around the world on multi-year initiatives that help protect nature, accelerate new technologies, and ensure crucial financing

- Our suppliers to embed sustainable practices and reduce emissions

For a full list of partners, see our latest ESG Report.

Learn more

Approval process for joining ESG-related coalitions

Environmental, Social, and Governance (ESG) Report

Our annual environmental, social, and governance (ESG) report captures our measurable progress toward driving positive, enduring change in the world.